Fast and simple access to liquidity pools on major crypto exchanges. Aggregation, hedging, mapping of symbols, synthetic instruments, risk parameters. All these and many more other features are available.

Marksman Hub – it’s your reliable gateway into digital asset liquidity pools. Supports spot and perpetual futures liquidity.

What is MarksMan

Fast Setup in

10 Days

Technical Support

24/7

Connectivity

FIX/WSS/REST

Ways To Provide Liquidity

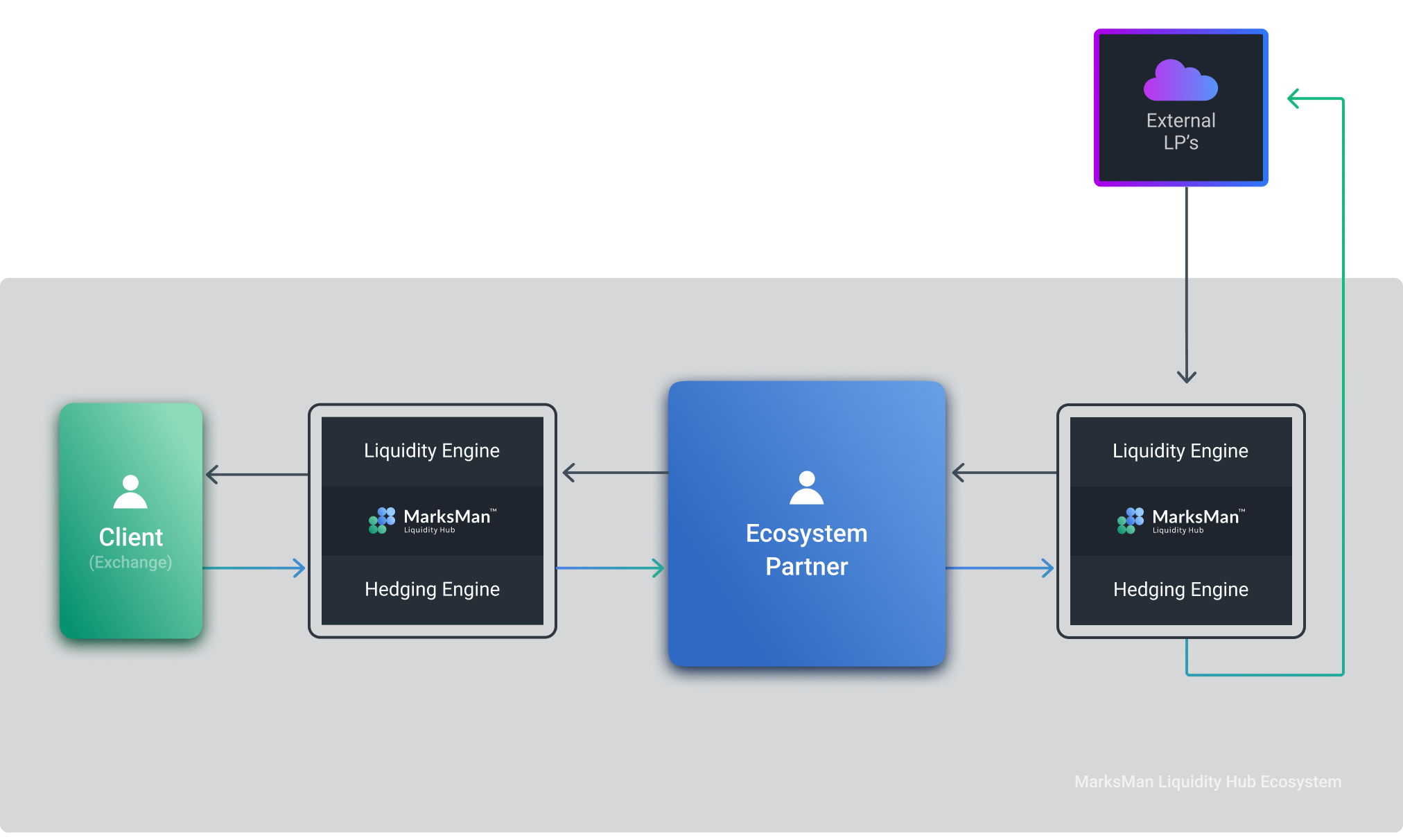

Ecosystem

MarksMan Ecosystem is an interconnected community of platform-accredited Liquidity Providers and

Client Instances, making available an unmatched level of user experience for their end users.

Ecosystem Participants

Ecosystem Takers or Clients

Customers operating a supported instance of an exchange system (such as BzTrader)

- Employ the MarksMan platform to access the liquidity made available by Liquidity Providers on the Ecosystem List (Ecosystem Partners), external Liquidity Providers, and Market Data Aggregators

- Hedge price risks at supported Liquidity Providers, both those on the Ecosystem List, and external Liquidity Providers

Ecosystem Makers or Partners

Liquidity Providers, who entered Ecosystem List as liquidity sources for the Client instances, and as platforms for price risk hedging for the Ecosystem Clients

Perpetual Futures

Documentation

Get detailed documentation, API references and other

helpful information for all of our products.

Key Features

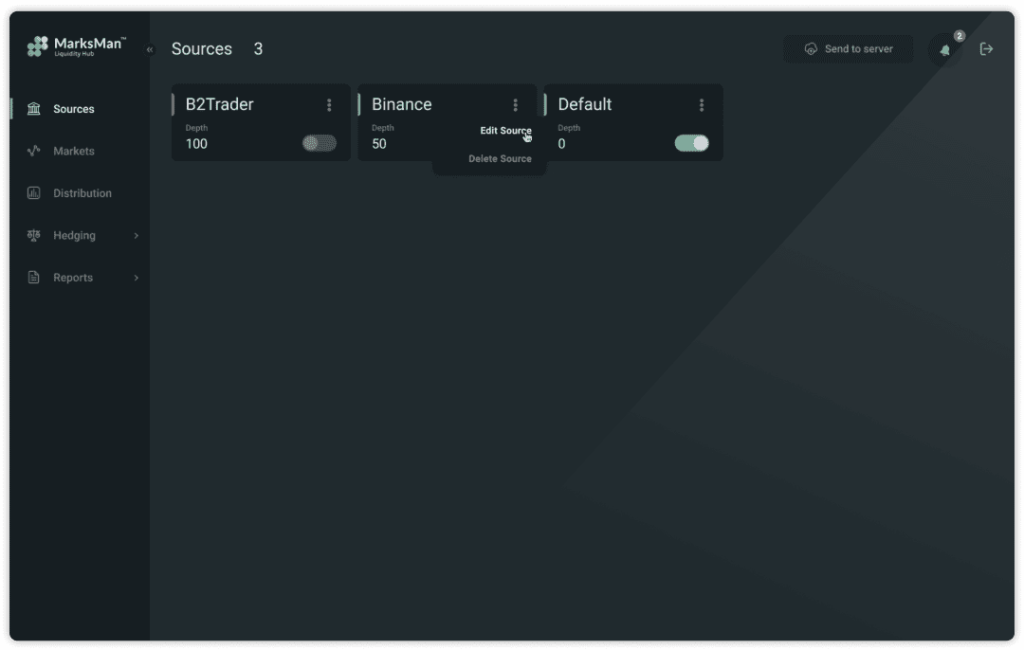

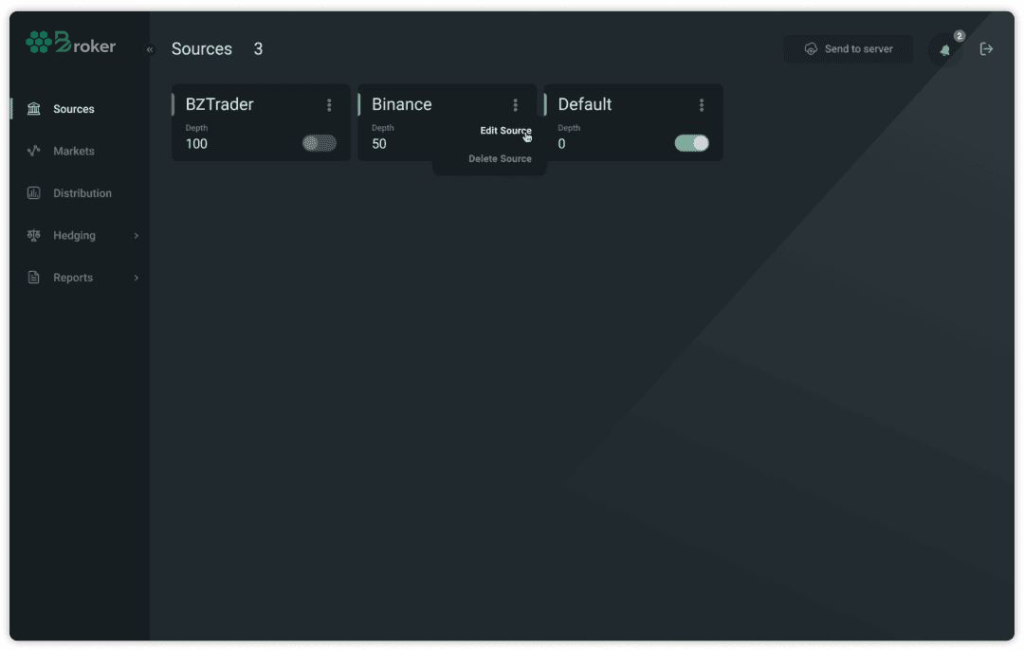

Price Discovery

The price discovery engine enables deriving the top-of-the-book prices as well as full-depth order books for spot assets through the Level 2 quotes from several sources, and by utilizing additional market data sources.

The number of trading instruments, order book depth and liquidity providers connected is limited only by your imagination and computing resources available.

Custom adapters to Liquidity Providers and Market Data Aggregators available on demand

Full market depth prices

Supported (FIX Protocol (Market Data), Websocket API, REST API, Public API, Private API)

Ready-made adapters connecting to supported Liquidity Providers

Top-of-the book prices

Price Construction

Flexible adjustment of liquidity streams by applying the granular configuration to the trading instruments and order books aimed at facilitating trades on one hand and reducing risks on the other. Markups, volume modifiers, order book depth, symbol mapping, decimal precision – are the parameters at your disposal to shape the liquidity on your platform.

Order book, liquidity and trading instrument selection as you see fit.

Order book depth

Modify the market depth, available to your customers

Volume modifiers

Amplify or reduce volumes, represented in the order book

Decimal precision

Markups

Symbol mapping

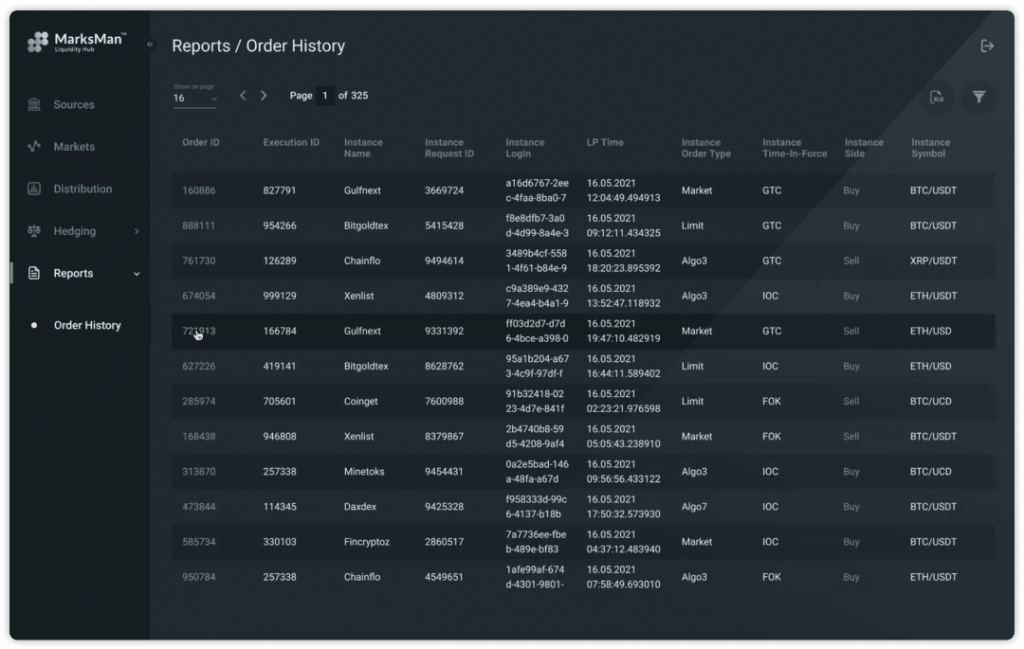

Reporting

Comprehensive reporting on all aspects of hedging orders, execution quality data, timing and other crucial information. End user trade request details, hedging order placement data, hedging order execution stats available. Searchable order history is provided with sophisticated filters in place.

All the necessary information about trades and hedge orders at your fingertips to keep track on risk hedging and to support your decisions.

Export to convenient data formats

Drill down for order details

Search/filter by all fields

Easily accessible information

Risk Hedging

Available from a wide selection of Liquidity Providers on Ecosystem List, Supported List, or any external Liquidity Provider via custom adapters.

Simple yet powerful features to hedge your price risks.

Connection to one or more Liquidity Providers

Comprehensive reporting

Execution quality monitoring

Flexible hedging parameters:

-Hedge Ratio – 0..100%, configurable by User Account, Hedging Platform, Symbol, etc.

-Hedging Platform selection and whitelisting

-Hedging Order Type, Time-in-Force

-Hedging instrument symbol override

-Min and Max Order Size for the hedging purposes

Liquidity Provider Connectivity

Seamless connection to a variety of Liquidity Providers

and Market Data Aggregators via numerous methods.

MarksMan connectivity solutions allow for improved price discovery, liquidity access, and trade execution at high speed and low latency, catering to the most demanding institutional clients, crypto exchanges, and retail brokers, dealing in spot cryptocurrency markets.

Market Data API, Trading API, Account Management API

Ready-made adapters to Liquidity Providers

Custom API adapters may be developed on demand

FIX Protocol, Websocket API, REST API supported

Public and Private API

API Keys Setup

A quick and easy interface to establish secure access to a hedging account on a chosen liquidity provider by entering keys to trading API.

Strong encryption is applied; the API keys may only be added or replaced in their entirety

Add or remove API keys to establish connection

Connection status is prominently displayed

Synthetic Instruments

Create new synthetic instruments by combining separate symbols, inverting base and quote assets, and applying fractions to enable effective liquidity feeds of the novel artificial pairs offered by your market-making business or at your trading venue.

Artificial asset pairs

for example, μBTC/DOGE

Fractional instruments

such as μBTC

Synthetic crosses

combine ETH/USDT and XRP/USDT to offer ETH/XRP

Account Management System

True multi asset Account Management System. Account status, as well as account details, such as Balance, Equity, Unrealized and Realized PnL always at your fingertips. Granular user access administration to make certain who has the rights to Deposits/Withdrawals, Position Management, Reporting and other account management features.

Manage open positions of an account or a group of accounts

View/sort/search the trades for any period of time

Select an account or a list of accounts to work with

Review the balance operations, select time periods and get alerts

Monitor the negative balance protection status and other crucial account information

Packages

We have specifically developed our package solution so that potential

clients can find the best fit for their business.

Use Cases

Basic Package

Ecosystem-based deployment

The Client exchange receives the liquidity from the Ecosystem Partner

(such as BzBX), and hedges the price risks on the Ecosystem Partner.

The connectivity extends to one Ecosystem Partners or a number of them.

Advanced Package

Hybrid Deployment

The Client exchange may chose to receive the liquidity from

either or both of the following sources, as well as hedge risks:

Ecosystem Partner (such as BzBX),

or multiple Ecosystem Partners

One External LP,

such as Binance

Enterprise Package

Universal connectivity deployment

The Client exchange may chose to receive the liquidity from

either or both of the following sources, as well as hedge risks:

Ecosystem Partner (such as BzBX),

or multiple Ecosystem Partners

Up to 6 External LP,

such as Binance, etc.

Customer support

Email us

Our professional customer service team is available to assist you with any queries.

Use ticket system

Get our assistance directly from the platform.

Use Slack

You will be assigned with a personal manager speaking your language

Architecture

MarksMan Liquidity Infrastracture

Fees & Pricing

All pricing details are gathered here for your convenience.

Check them out.

Get your Marksman

Request a presentation, try a demo and offer investment products

in your company!

FAQs

Have a question? A source of useful information about our products and services.

No, we offer a cryptocurrency payment gateway which is capable of accepting any crypto but not fiat currency.

We do not reveal any names. We sign a NDA with our clients and therefore do not disclose their details.

Yes we do. As soon as you acquire our services we will provide you with an Account Manager for general questions and 24/7 technical support. We also run training sessions for our customer’s teams with our product managers.

We offer our liquidity services on institutional conditions with SWAPs. But you as a broker can create an Islamic account type with storage as a payment for holding positions overnight for your clients.

Yes you can. No one will see the BzBroker logo on your TR or MetaTrader terminals.

It comes best with

Our liquidity is best combined with the leading industry trading

platforms to provide the ultimate in performance and user satisfaction.

Highly customizable and scalable trading platform. All that is needed to start a brokerage business in one package.

- SAAS Core Products

- Liquidity

- Useful Links

- White Label Trading Platforms

- Turnkey Exchange

- Corporate Services

- Money Management

- Turnkey Brokerage

- Crypto Processing

- Software Solutions/Services