Liquidity Providing

Liquidity Providing Is A Gateway to Enhanced Trading

Cryptocurrencies are changing the way we perceive and engage with financial markets. With new tokens and coins emerging constantly, the world of digital assets is expanding at an unprecedented rate. If you’re a cryptocurrency investor or trader, you’ve probably heard about liquidity providing, but what does it really mean, and why is it essential?

What Is Liquidity Providing?

Liquidity providing is a fundamental concept in the world of cryptocurrency trading. It involves individuals or entities participating in the market by supplying digital assets to be bought or sold. These participants act as market makers, facilitating smoother and more efficient trading by ensuring that there are enough assets available for transactions.

The Benefits of Liquidity Providing

Enhanced Market Efficiency: Liquidity providers contribute to market stability by reducing price fluctuations and ensuring that assets can be traded promptly. This results in a more efficient and predictable trading environment.

Reduced Spread: A narrower spread (the difference between the buying and selling prices) means traders can buy and sell assets more closely to the current market price, saving on transaction costs.

Increased Trading Volume: Liquidity providers attract more traders by offering better conditions for trading, leading to higher trading volumes. This, in turn, can attract new investors to the market.

Profit Opportunities: Liquidity providers can earn profits through fees or spreads by supplying assets to the market. The more assets you provide, the more you can potentially earn.

Liquidity Provider Hub

Your Gateway

Your custom Hub serves as the gateway for seamless interactions with all your counterparties, offering shared and personalized streams. It supports sweepable, full amount, and customized streams for a variety of instruments. The Liquidity Provider Hub excels in rapid, low-latency processing of quotes and responses across all financial instruments.

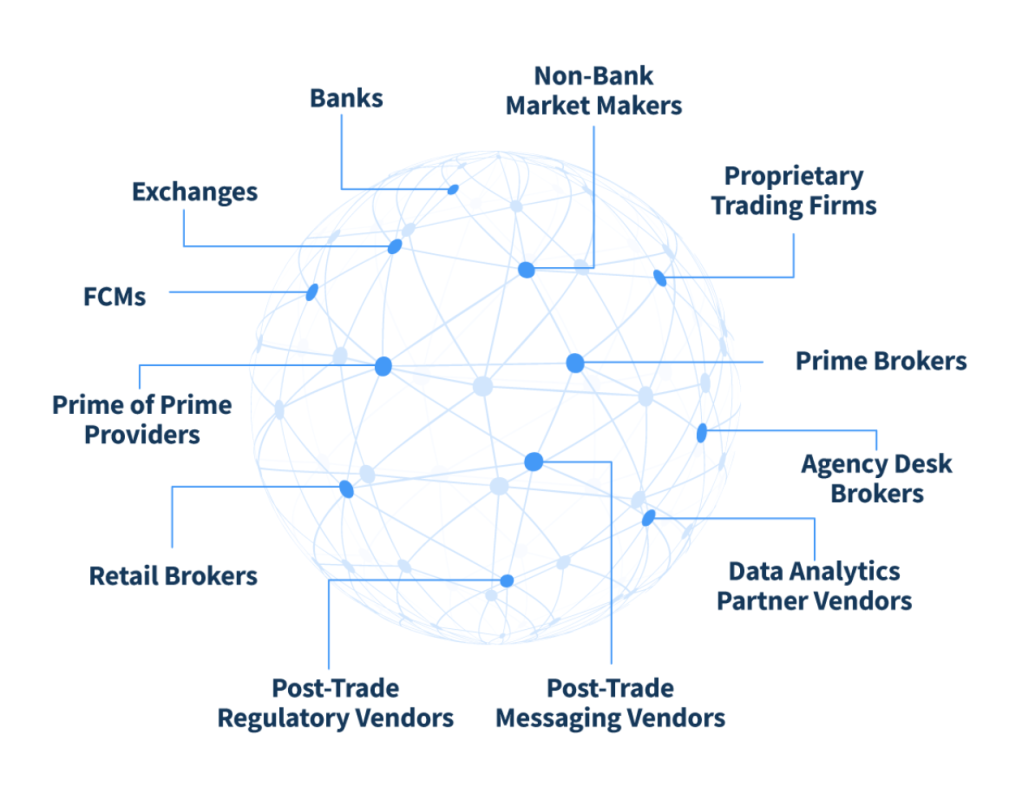

EcoSystem

Market Connectivity

Gain entry to a network comprising more than 200 worldwide FX brokerages, collectively hedging over 10 billion USD externally daily as an Ecosystem Partner. Benefit from direct relationships between liquidity providers and customers, enabling both parties to enhance their market dynamics.

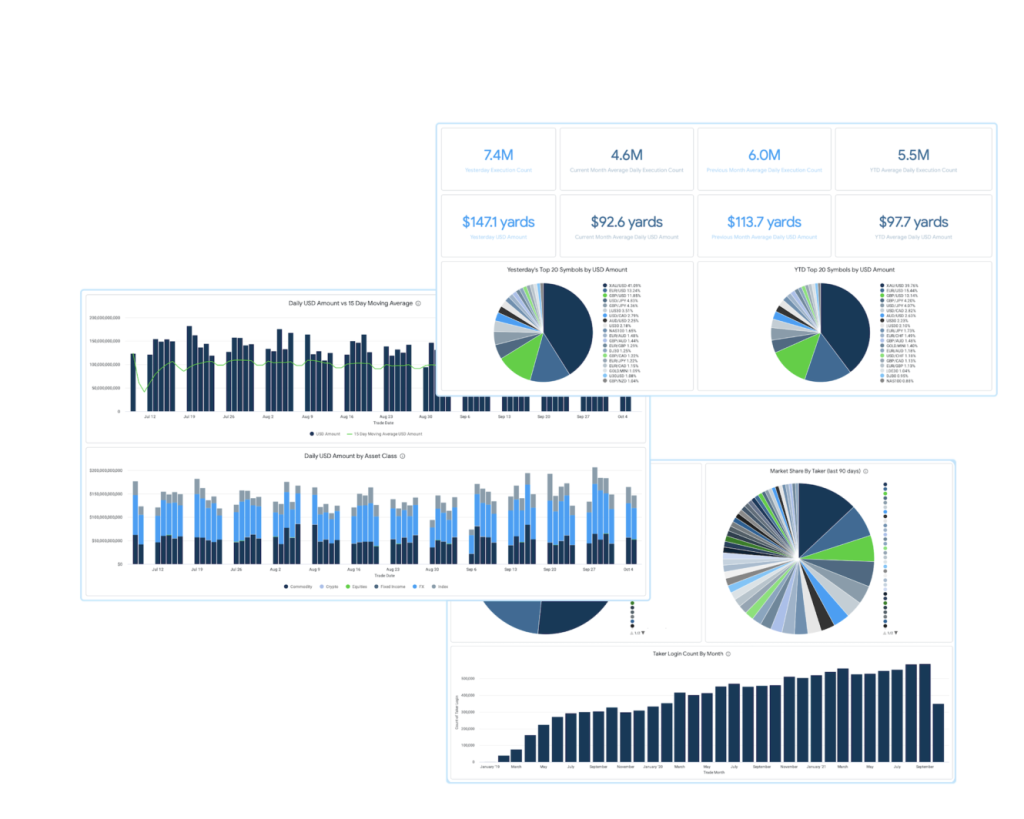

Data Source

Advanced Analytics for Business Insights

Discover optimization opportunities for hedged flow and enhance relationship management with our cutting-edge, cloud-based business intelligence toolkit. This tool securely stores your quote and trade data, transforming it into advanced analytics. Through impartial data representation, we facilitate meaningful connections between liquidity consumers and providers. This enables you to engage in effective dialogues with your Hub clients.

Performance Metrics and Availability

Institutional Hub clients have access to comprehensive performance statistics. This information empowers them to strategically manage the balance between the sophistication of their pricing and risk management and the crucial element of latency. Liquidity providers benefit as our clients optimize their Hubs for swift execution decision-making.

How to Get Started?

If you’re interested in becoming a liquidity provider, the process is relatively straightforward. You need to choose a suitable platform or exchange that offers liquidity providing services. Once you’re set up, you can begin by depositing the digital assets you want to provide liquidity for.

Keep in mind that liquidity providing does involve some risks, particularly related to asset price fluctuations. It’s essential to conduct thorough research and understand the dynamics of the specific market you’re entering.

In Conclusion

Liquidity providing is a crucial aspect of the cryptocurrency market that benefits both traders and investors.

By supplying assets to the market, liquidity providers enhance market efficiency, reduce trading costs, increase trading volumes, and create profit opportunities. If you’re considering this avenue, start by choosing a reliable platform and proceed with caution, and you’ll be well on your way to becoming a liquidity provider in the world of digital assets.

- SAAS Core Products

- Liquidity

- Useful Links

- White Label Trading Platforms

- Turnkey Exchange

- Corporate Services

- Money Management

- Turnkey Brokerage

- Crypto Processing

- Software Solutions/Services