White Label cTrader

White Label cTrader is a full-featured brokerage infrastructure used by both institutional businessess and retail broker dealers worldwide. By utilizing our white label solutions, brokerages can get up and running quickly, offering their clients a branded, fully-customizable experience that reflects their individual tastes and preferences.

What is White Label cTrader?

White Label cTrader allows you to quickly and easily establish yourself as a FOREX broker, Crypto broker, or Multi-Asset broker.

You don’t have to worry about things like buying a cTrader server license or setting up a backup system, establishing a global network of access servers, or hiring people to configure and maintain the server structure constantly — White Label cTrader comes with all of these features and more.

cTrader is known to be one of the most advanced trading platforms on the market featuring modern UI and extended trading flow management solutions

Account management tools

Create, modify and remove accounts. Set margin levels and alerts. Positions, trades, balances monitoring.

Advanced risk control

Tier margin and multiple levels of margin alerts. Hybrid order execution system.

100% tested features

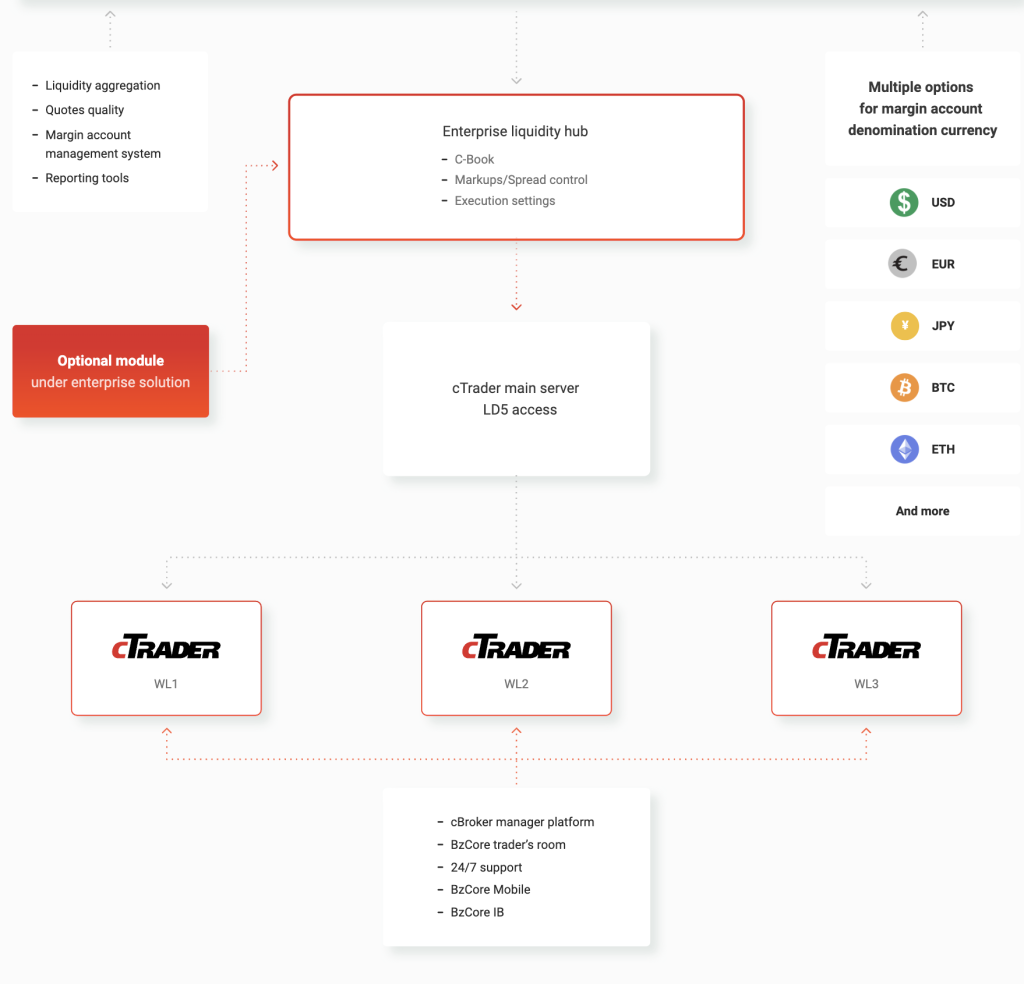

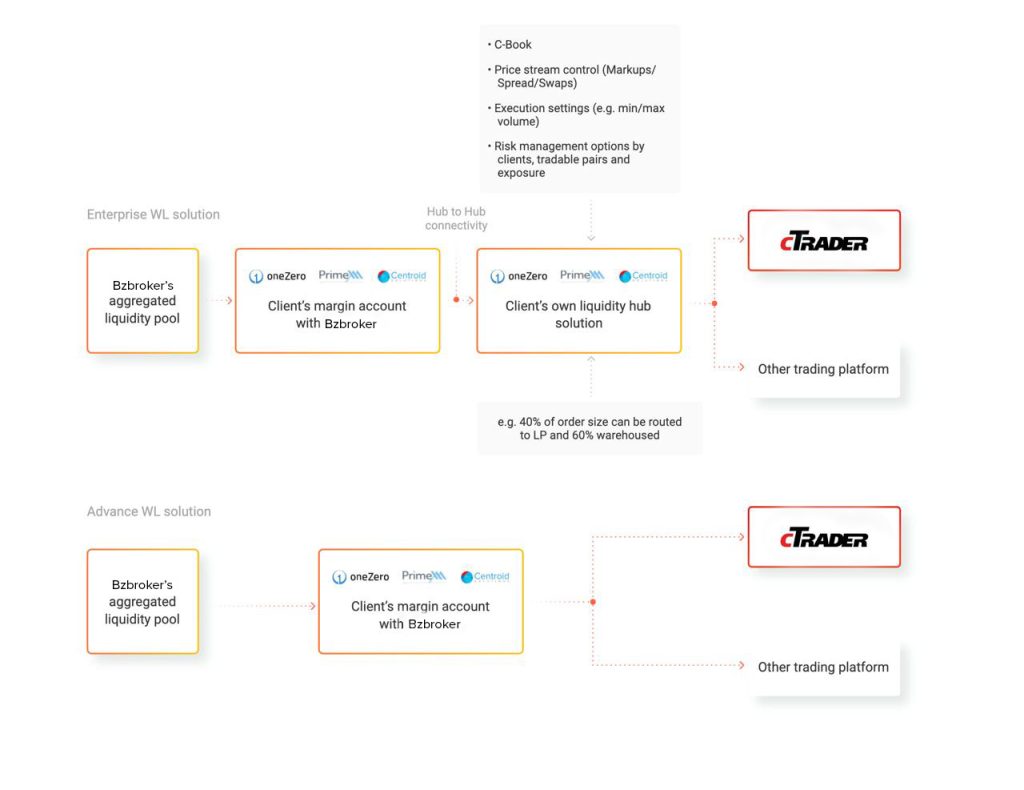

cTrader WL Structure

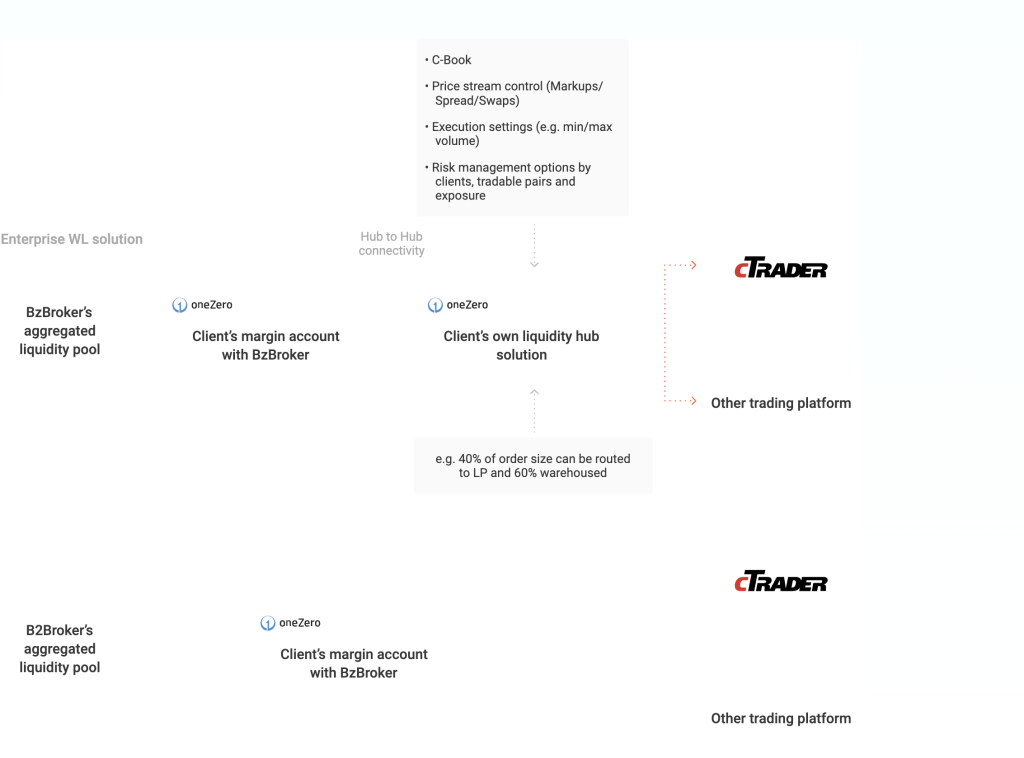

White Label cTrader Setup Options

Advanced and Enterprise solutions for risk management and price streams control.

Margin account denomination

Provide your traders with a wide range of account currency denomination options

![]()

![]()

![]()

![]()

![]()

And reduce your risk by linking trading groups to respective margin accounts in two ways:

Multicurrency denominated margin account

Multicurrency based margin accounts allow brokers to minimize volatile risks between clients’ equity and brokers’ equity. Margin accounts can be denominated in any currency from the BzBroker liquidity, including cryptocurrencies. Client accounts in different currencies which are correlated to each other can be connected to the one margin account. BNB and BTC based accounts can easily work with BTC based margin account with minimal risk on volatility differences between these two currencies, as an example.

Without taking the risk

Recipients Configuration

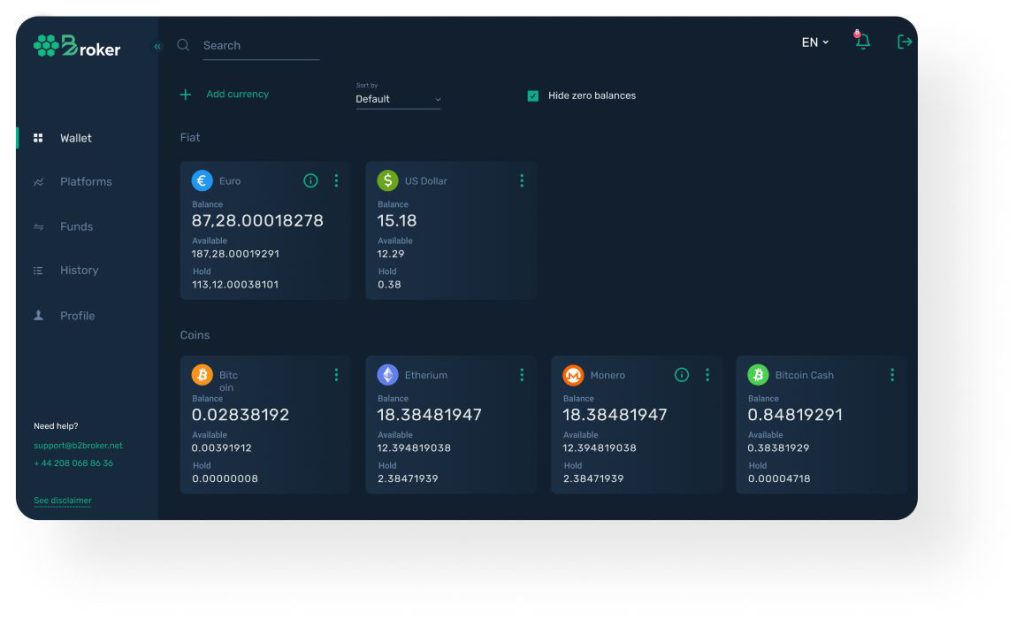

cBroker

cBroker – a back-office application designed to handle trade enquiries and manage customer accounts. cBroker is an administrative tool and settings panel which combines and follows every detail going through the system. Crafted for simplicity of use, cBroker gives you full control over your trading environment. Completely transparent operations and details are always at your disposal, giving you full control of every component.

Accounts management system

Сomplete, real-time access to all the trading accounts including trading activity and history, margin information, balance information, personal details, and account settings, all in a single place.

Symbol and price stream settings

Customize your tradable assets according to your needs. Including swaps, dividends, markups and spreads.

Exposure monitoring

Dealer tab

Swaps and Dividends profile

Get full control over the charges you apply for your traders.

Reporting settings

Get all the data you need with ease in accordance with predefined profiles.

Work with customer analytics

Work with risk management

Customize display & export data

Customize price stream

Create, open, modify, close and delete trading orders

Create reports and report profiles, export data

Modify spreads, markups, swaps on the fly

Create, modify and delete accounts

Key features of cTrader

Build your own platform on top of cTrader using open API

Build your own web, mobile and desktop applications.

Use cTrader Broker OAuth and In-app Controls to make your users feel at home

Use cTrader Open API to build your own custom trading applications

Fully branded and customized platform

Tailor the platform to your company’s look and feel, as well as your traders’ needs. cTrader White Label’s flexibility, you can easily do that.

Сustom logos, banners and icons

Label owner contact details

Key benefits and technical features of the cTrader WL solution

cTrader’s advanced trading capabilities in addition to BzBroker’s aggregated liquidity pool and ongoing support to its clients offer a unique proposition for brokerage businesses.

Various balance and credit operations

A convenient feature that allows you to keep track of your money in a more organized fashion.

Hedging and netting model support on cTrader

Both models of position management are available.

Market sentiment

Indicates the percentage of client accounts that expect the price to rise or fall respectively. Data is collected across multiple cTrader servers

Advanced market depth module

A comprehensive assessment of market depth with three distinct views– Standard depth, Price depth, and VWAP depth. Helps traders greatly in assessing market liquidity.

Full environment integration

The WL cTrader as a part of the complex solution includes Liquidity, Trading platform, Trader’s Room, Payment System, IB Program solutions.

Training session for WL staff

WL employees will receive a thorough introduction to the cBroker and Trading Platform interfaces and features in a training session.

C# based algo trading

Automated trading bots and custom indicators builder with backtesting capabilities. Natively integrated with cTrader.

Legal aspects

We handle all the legal necessities during setup to make sure your brokerage is operating lawfully.

Modern UI

A flexible widget based user interface. Customize your trading space according to your needs.

cTrader Copy

A fully integrated cTrader feature and a flexible investment platform that allows copying trading strategies.

Transparent pricing

There is no involvement from Market Makers in the pricing process; rather, prices are taken directly from liquidity aggregators.

Prime of Prime liquidity

Get access to aggregated liquididty pool of tier 1 banks and non bank providers

Third party integrations

BzCore TR, Payment systems, IB Software Solution are available.

Technical support

We have you covered around the clock with dependable, multilingual, fast support service.

Demo environment

Training and testing can be done in a demo environment.

STP

STP trades on the A-book are executed quickly and reliably with virtually no latency.

Fast changes on request

All necessary changes for the completed WL in 24 hours.

Trading conditions

cTrader Copy

cTrader Copy is a fully integrated cTrader feature and a flexible investment platform that allows copying trading strategies, as well as providing one’s own strategies for copying by other traders.

Prime of Prime Liquidity Pool

1000 + trading instruments

7 asset classes with the most popular instruments from Tier 1 Liquidity. More than 1000 trading instruments are available for FOREX, Metals, Commodities, Indices, Cryptocurrencies, Equities and ETFs.

Solid expertise

BzBroker is a leading liquidity provider because of its stellar reputation, extensive knowledge of the financial markets, and access to cutting-edge tools.

What to do?

Buying WL cTrader BzBroker solution vs Getting your own server

You’ll need to invest in a trading server, but you’ll also need to staff a team of at least ten people to maintain it and deal with things like hosting, plugins, infrastructure, liquidity providers, and multilingual, round-the-clock technical support. Spending a lot of time and money on people and equipment is necessary. Thus, it’s easy to see how much money can be saved with the White Label solution.

Different order types

Fill policy

Return

IOC

FOK

Protection orders

Stop Loss

Stop-loss orders can be placed in either the buy or sell direction. Long positions can be protected by sell-stop orders, which cause a market sell order to be executed if the price falls below a certain threshold. Short positions are protected by buy-stop orders. They will be set at a level higher than the current market price and will activate if the price goes over that point.

Take Profit

Pending orders

Limit

A limit order refers to an order to buy or sell an asset at a predetermined price or better. However, limit orders will not be executed until the price of the underlying securities does not match the order’s criteria.

Stop

Whenever an asset moves beyond a certain threshold, a stop order is triggered. As soon as the price rises over the specified limit, the stop order becomes a market order and is filled at the best current market price.

Stop Limit

An order with a stop-limit price specifies the lowest possible price at which the order will be filled. Each stop-limit order specifies two prices: the stop price, at which the order is automatically converted to a sell order, and the limit price. The sell order changes from a market order to a limit order, which means it will only be fulfilled if the price meets or exceeds the specified limit.

Trailing Stop

The purpose of this sort of order is to either take profits or limit losses as a trade goes positively for a trader.

A trailing stop moves when prices move in the

right direction. It does not reverse course

after making a move to preserve a gain or limit a loss.

Close by Orders

A Close-By order cancels out two hedged orders at the same time. It saves you money because you only have to pay one spread for two orders. Hedged orders closed independently will result in two spreads, thereby costing twice as much.

Market Orders

An order with no specified price, which is placed to meet or accept the current market Best Bid or Offer. Orders are executed at the best available price and may be partially filled at various prices.

What is included?

Organization and maintenance of a reliable backup system

Organization and maintenance of trading servers while ensuring a reliable backup system is implemented.

Configuration and support of the server structure 24/7

Global access server network

Server licenses cTrader

Strong failover system

cTrader has a strong backup system which is used to build a stable failover service.

Account statements

Quotes control mechanisms

Liquidity aggregation

Our WL solution comes in with our own liquidity clusters. We aggregate pricing from multiple sources achieving the tightest spreads on the market and rich order book depth

API

Integrations with other systems, such as customer relationship management software and backend systems, can be accomplished with the help of a fully functional API.

Components you need to launch your broker with cTrader WL

Technologies required for running a successful brokerage can be divided into the following components:

Proxy servers all around the world

cTrader

Trading Applications

For smartphones

For smartphones

Watch the video

If you’re looking to set up your own brоkеrage business, should you choose Fоrеx or Crуptо? Find out more about what each sоlution offers and what is the best chоice for you.